Fica withholding calculator

The employer and the employee each pay 765. Earnings Withholding Calculator.

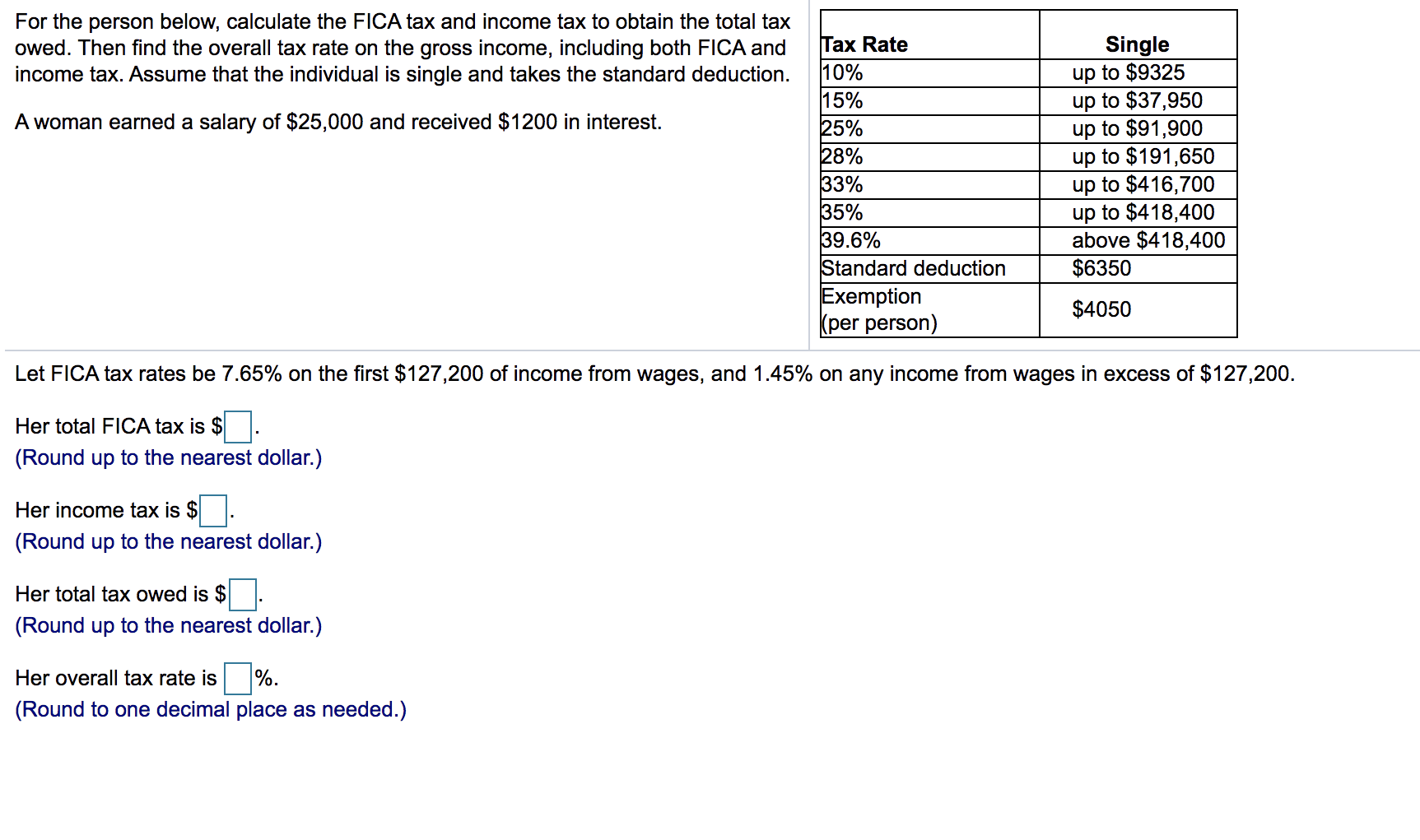

Solved For The Person Below Calculate The Fica Tax And Chegg Com

The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator.

. Urgent energy conservation needed. Get the Latest Federal Tax Developments. It is possible to have been overwithheld for OASDI FICA taxes in the event that the.

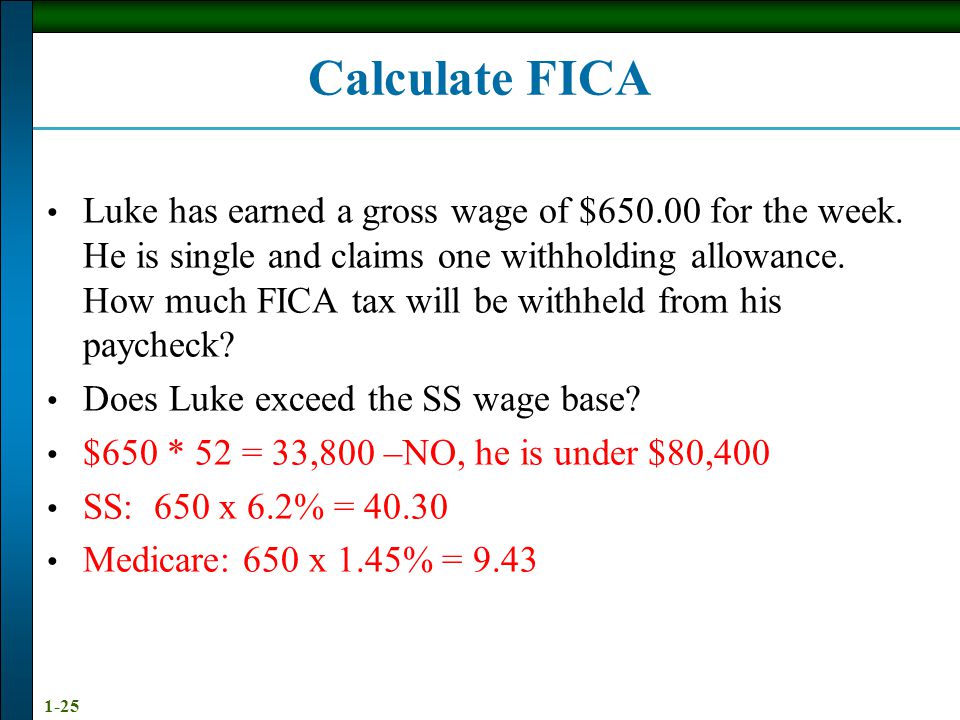

And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your employer would have paid if. To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax rates. Get the Latest Federal Tax Developments.

This calculator is a tool to estimate how much federal income tax will be withheld. This means together the employee and. Raise your AC to 78 from 4pm - 9pm.

For help with your withholding you may use the Tax Withholding Estimator. You can use the Tax Withholding. The tool has features specially tailored to the unique needs of retirees receiving.

Employers remit withholding tax on an employees behalf. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

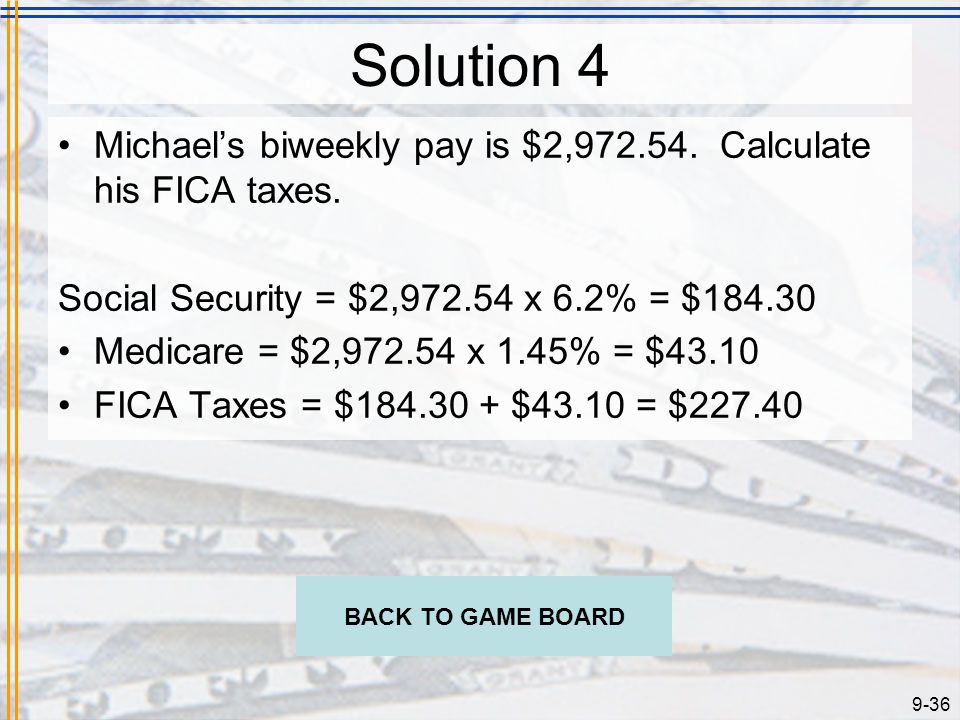

For example if an employees taxable wages are 700. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62. Social Security and Medicare Withholding Rates.

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Estimate your federal income tax withholding. These tax calculations assume that you have all earnings from a single employer.

Turn off unnecessary lights appliances - Learn more at. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. How It Works.

The information you give your employer on Form W4. Federal income tax and FICA tax. 2 or 62 would be applied against the employers payroll tax for that cycle.

This is a projection based on information you provide. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

See how your refund take-home pay or tax due are affected by withholding amount. How Your Paycheck Works. See how FICA tax works in 2022.

2 or 62 would be deducted from the employees gross earnings and would be filed with the IRS. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. 2022 Federal Tax Withholding Calculator.

Use this tool to. The Federal Insurance Contributions Act FICA is a federal law that requires employers to withhold three different types of employment taxes from their employees.

Easiest 2021 Fica Tax Calculator

Ex Tax Percent Application Find The Amount Of Fica Tax Paid Youtube

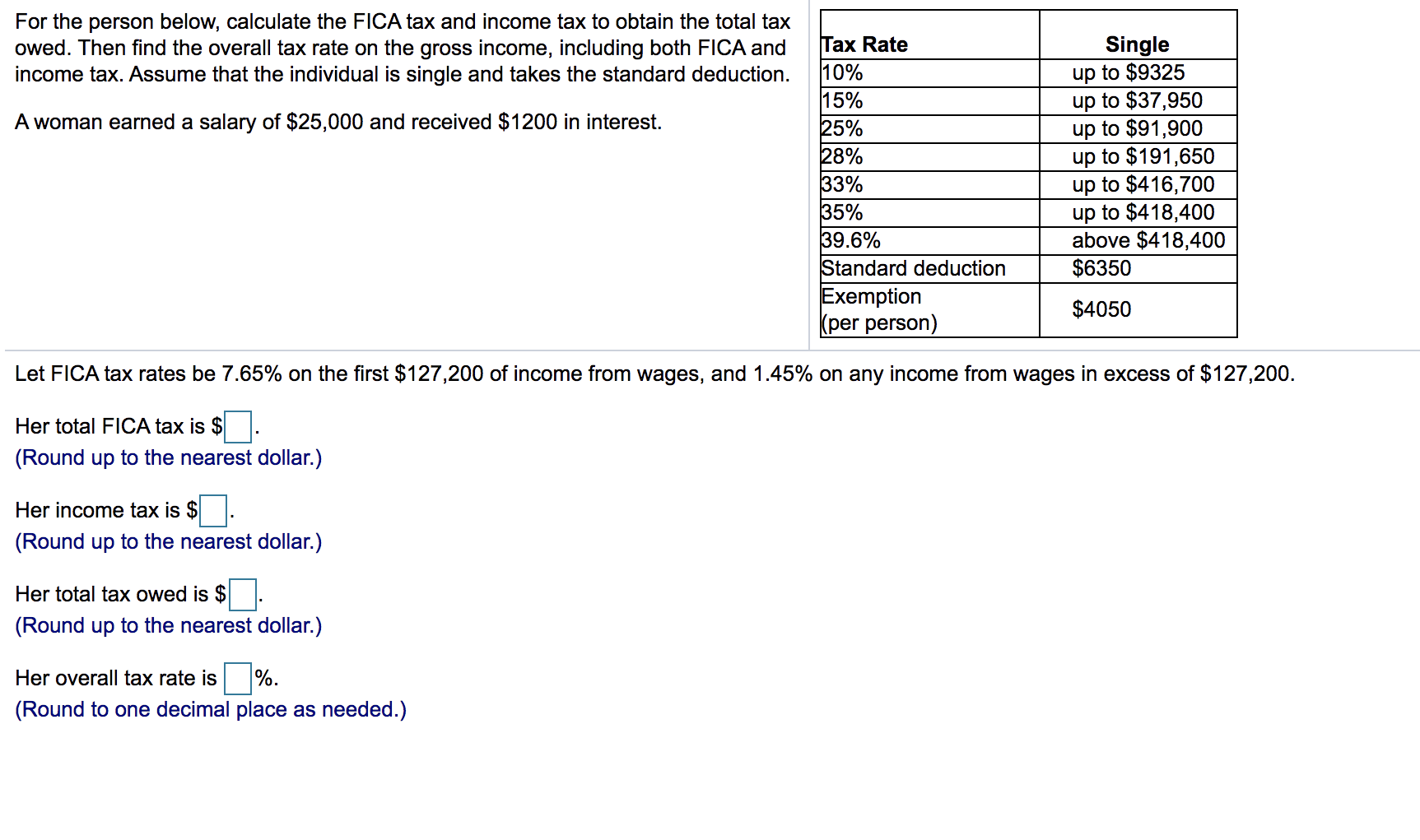

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Paycheck Calculator Take Home Pay Calculator

Chapter 9 Payroll Mcgraw Hill Irwin Ppt Download

Question 3 The Social Security Or Fica Tax Has Two Chegg Com

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

Employee Earnings And Deductions Ppt Video Online Download

Fica Social Security Medicare Taxes Youtube

Excel Busn Math 41 Payroll Deductions With Ceilings Fica Youtube

How To Calculate Fica For 2022 Workest

What Is Fica Tax Contribution Rates Examples

Chapter 9 Taxes Start Exit Ppt Download

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

What Is And How To Calculate Fica Taxes Explained Social Security Taxes And Medicare Taxes Youtube

Chapter 9 Payroll Mcgraw Hill Irwin Ppt Download